Learning Library

Go To--> Learn About | Benefits

Article: Student Debt is Pushing Elders into Poverty

Student Debt is Pushing Elders into Poverty

Table of Contents

- Student Debt is Pushing Elders into Poverty

Unfortunately, student loan debt is not a problem limited to Millennials. An increasing number of older Americans have defaulted on their federal student loans. These defaults can result in a portion of their Social Security retirement or disability benefits being withheld – known as an offset. Generally, creditors cannot garnish Social Security benefits, but there is an exception for federal debts such as Medicare, IRS, SSA, and federal student loans. An offset can be as much as 15% of a person’s Social Security benefit.

Because Social Security is often the primary source of income for older Americans, the U.S. Government Accountability Office (GAO) recently conducted a study regarding this situation. The GAO found that 43% of older borrowers (age 50 and older) who were subject to the offset for the first time had held their student loans for 20 years or more. In addition, three-quarters of these older borrowers had taken loans out only for their own education, and most owed less than $10,000 at the time of their initial offset. More than half of the nearly 114,000 older borrowers who had such offsets were receiving Social Security disability benefits rather than Social Security retirement income.

The GAO identified a number of effects on older borrowers resulting from the design of the offset program and associated options for relief. One of the few avenues for relief is through a process known as a total and permanent disability (TPD) discharge. It is available to borrowers with a disability that is not expected to improve. The Department of Education determines whether a borrower meets the criteria for TPD discharge. If, however, a borrower’s loans are discharged and he or she fails to comply with annual reporting requirements, a loan initially approved for TPD discharge can be reinstated and offsets resume.

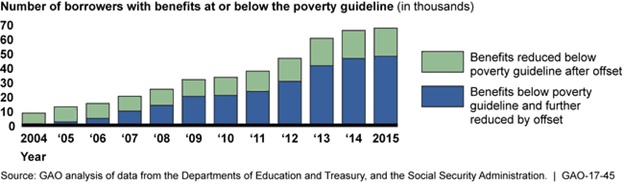

Perhaps the most alarming effect the GAO identified is that older borrowers subject to an offset are increasingly receiving benefits below the federal poverty guideline.

As a result of this study, the GAO has suggested that Congress consider adjusting the Social Security offset provisions to reflect the increased cost of living. The GAO is also making recommendations to the Department of Education, including that it clarify documentation requirements for TPD discharge.

By the GWAAR Legal Services Team, 2017

Last Updated on 5/17/2017